Where to Send Work Authorization Application While in Removal

Start Preamble Start Printed Page 74196

AGENCY:

Department of Homeland Security.

ACTION:

Notice of proposed rulemaking.

SUMMARY:

The U.S. Department of Homeland Security (DHS) is proposing to eliminate employment authorization eligibility for aliens who have final orders of removal but are temporarily released from custody on an order of supervision with one narrow exception. DHS proposes to continue to allow employment authorization for aliens for whom DHS has determined that their removal is impracticable because all countries from whom travel documents have been requested have affirmatively declined to issue a travel document and who establish economic necessity. DHS intends for this rule to reduce the incentive for aliens to remain in the United States after receiving a final order of removal and to strengthen protections for U.S. workers.

DHS is also proposing to clarify that aliens who have been granted a deferral of removal based on the United States' obligations under the United Nations (U.N.) Convention Against Torture and Other Cruel, Inhuman or Degrading Treatment or Punishment (CAT) are similarly situated to aliens granted withholding of removal under the Immigration and Nationality Act (INA) and regulations implementing CAT, in that they cannot be removed to the country in question while the order deferring their removal is in place. As such, DHS is proposing to treat aliens granted CAT deferral of removal as employment authorized based upon the grant of deferral of removal.

DATES:

Written comments on this proposed rulemaking must be submitted on or before December 21, 2020. Comments on the collection of information (see Paperwork Reduction Act section) must be received on or before January 19, 2021. Comments on both the proposed rulemaking and the collection of information received on or before December 21, 2020 will be considered by DHS and USCIS. Only comments on the collection of information received between December 21, 2020 and January 19, 2021 will be considered by DHS and USCIS. Note: Comments received after December 21, 2020 on the proposed rulemaking rather than those specific to the collection of information will not be considered by DHS and USCIS.

ADDRESSES:

You may submit comments on the entirety of this proposed rulemaking package, identified by DHS Docket No. USCIS-2019-0024, through the Federal eRulemaking Portal: http://www.regulations.gov. Follow the website instructions for submitting comments.

Comments submitted in a manner other than the one listed above, including emails or letters sent to DHS or USCIS officials, will not be considered comments on the proposed rule and may not receive a response from DHS. Please note that DHS and USCIS cannot accept any comments that are hand-delivered or couriered. In addition, USCIS cannot accept comments contained on any form of digital media storage devices, such as CDs/DVDs and USB drives. Due to COVID-19, USCIS is also not accepting mailed comments at this time. If you cannot submit your comment by using http://www.regulations.gov, please contact Samantha Deshommes, Chief, Regulatory Coordination Division, Office of Policy and Strategy, U.S. Citizenship and Immigration Services, Department of Homeland Security, by telephone at (240) 721-3000 for alternate instructions.

Start Further Info

FOR FURTHER INFORMATION CONTACT:

Michael J. McDermott, Chief, Security and Public Safety Division, Office of Policy and Strategy, U.S. Citizenship and Immigration Services, Department of Homeland Security, 5900 Capital Gateway Drive, MD, Camp Springs 20746; Telephone (240) 721-3000.

End Further Info End Preamble

SUPPLEMENTARY INFORMATION:

This supplementary information section is organized as follows:

Table of Contents

I. Public Participation

II. Executive Summary

A. Major Provisions of the Regulatory Action

B. Summary of Costs, Benefits, and Transfer Payments

III. Purpose of the Proposed Rule

A. Enforcement Priorities

B. Strengthening Protections for U.S. Workers

C. Exception to Employment Authorization Bars

IV. Background

A. Legal Authority

B. Detention and Release of Aliens Ordered Removed

C. Repatriation of Aliens Ordered Removed

D. Withholding of Deportation or Removal Under the INA and Regulations Implementing CAT and Deferral of Removal Under Regulations Implementing CAT

E. Employment Authorization

F. Biometric Submission

V. Discussion of the Proposed Rule

A. Eligibility for Employment Authorization for Aliens on Orders of Supervision

B. USCIS Evidentiary Requirements

C. Biometric Submission and Criminal History

D. Aliens Granted Deferral of Removal Under the Regulations Implementing CAT

E. Effective Date of the Final Rule

F. Additional Amendments

VI. Statutory and Regulatory Requirements

A. Executive Orders 12866 (Regulatory Planning and Review) and 13563 (Improving Regulation and Regulatory Review)

1. Summary

2. Background and Purpose of the Proposed Rule

3. Population

4. Costs and Benefits of the Proposed Rule

B. Regulatory Flexibility Act (RFA)

C. Congressional Review Act (CRA)

D. Unfunded Mandates Reform Act of 1995 (UMRA)

E. Executive Order 13132 (Federalism)

F. Executive Order 12988 (Civil Justice Reform)

G. Executive Order 13175 Consultation and Coordination With Indian Tribal Governments

H. Family Assessment

I. National Environmental Policy Act (NEPA)

J. Paperwork Reduction Act (PRA)

K. Signature

Table of Abbreviations

AEDPA—Anti-Terrorism and Effective Death Penalty Act

ASC—Application Support Center

BAHA—Buy American and Hire American (Executive Order 13788)

BIA—Board of Immigration Appeals

BLS—Bureau of Labor Statistics

CAT—Convention Against Torture and Other Cruel, Inhuman or Degrading Treatment or Punishment

CFR—Code of Federal Regulations

DCAT—Deferral of Removal Under the Regulations Implementing the Convention Against Torture

DHS—U.S. Department of Homeland Security

DOJ—U.S. Department of Justice

DOL—U.S. Department of Labor

DOS—Department of State

E.O.—Executive Order

EAD—Employment Authorization Document

EOIR—Executive Office for Immigration Review

E-Verify—Employment Eligibility Verification System

FARRA—Foreign Affairs Reform and Restructuring Act of 1988

FBI—The Federal Bureau of Investigation

Form I-9—Employment Eligibility Verification

Form I-765—Application for Employment Authorization Start Printed Page 74197

Form I-765WS—Form I-765, Employment Authorization Worksheet

FY—Fiscal Year

ICE—U.S. Immigration and Customs Enforcement

IIRIRA—Illegal Immigration Reform and Immigrant Responsibility Act of 1996

IJ—Immigration Judge

INA—Immigration and Nationality Act

INS—Immigration and Naturalization Service

LCA—Labor Condition Application

LPR—Lawful Permanent Resident

MOU-Memorandum of Understanding

NAICS—North American Industry Classification System

NEPA—National Environmental Policy Act

OMB—Office of Management and Budget

PRA—Paperwork Reduction Act

RFA—Regulatory Flexibility Act

RFE—Request for Evidence

Secretary—Secretary of Homeland Security

SSA—Social Security Administration

TLC—Temporary Labor Certification

TNC—Tentative Non-Confirmation

U.N.—United Nations

U.S.C.—United States Code

USCIS—U.S. Citizenship and Immigration Services

I. Public Participation

All interested parties are invited to participate in this rulemaking by submitting written data, views, comments, and arguments on all aspects of this proposed rule. DHS also invites comments that relate to the economic, legal, environmental, or federalism effects that might result from this proposed rule. Comments must be submitted in English, or an English translation must be provided. Comments that will provide the most assistance to U.S. Citizenship and Immigration Services (USCIS) in implementing these changes will reference a specific portion of the proposed rule, explain the reason for any recommended change, and include data, information, or authority that supports such recommended change.

Instructions: If you submit a comment, you must include the agency name and the DHS Docket No. USCIS-2019-0024 for this rulemaking. Regardless of the method used for submitting comments or material, all submissions will be posted, without change, to the Federal eRulemaking Portal at http://www.regulations.gov, and will include any personal information you provide. Therefore, submitting this information makes it public. You may wish to consider limiting the amount of personal information that you provide in any voluntary public comment submission you make to DHS. DHS may withhold information provided in comments from public viewing that it determines may impact the privacy of an individual or is offensive. For additional information, please read the Privacy and Security Notice that is available via the link in the footer of http://www.regulations.gov.

Docket: For access to the docket and to read background documents or comments received, go to http://www.regulations.gov, referencing DHS Docket No. USCIS-2019-0024. You may also sign up for email alerts on the online docket to be notified when comments are posted or a final rule is published.

II. Executive Summary

DHS seeks to align its discretionary authority to grant employment authorization to aliens ordered removed and temporarily released on orders of supervision with its current immigration enforcement priorities, which include the prompt removal of aliens who have received a final order of removal from the United States,[1] and the Administration's efforts to strengthen protections for U.S. workers. DHS is proposing to modify its regulations in the following areas:

- Employment authorization eligibility for aliens temporarily released on orders of supervision: DHS proposes to eliminate eligibility for discretionary employment authorization under 8 CFR 274a.12(c)(18) for aliens who have final orders of removal and are temporarily released from custody on orders of supervision pending removal except for aliens for whom DHS has determined that their removal is impracticable because all countries from whom DHS requested travel documents have affirmatively declined to issue such documents. DHS intends to require such aliens to establish economic necessity for employment during the period of the order of supervision.[2] Consistent with 8 CFR 274a.12(e), USCIS would use the Federal Poverty Guidelines under Title 45 of the U.S. Code to determine whether there is an economic necessity for employment authorization. Additionally, DHS proposes to expand the current nonexhaustive list of factors it considers when adjudicating an application for employment authorization for aliens temporarily released on an order of supervision to include: (1) The alien's compliance with the order of supervision conditions and (2) the alien's criminal history, including but not limited to any criminal arrests, charges, or convictions subsequent to the alien's release from custody on an order of supervision.

- Additional requirements for renewal employment authorization for aliens temporarily released on orders of supervision: DHS further proposes to allow aliens temporarily released on an order of supervision who apply for a renewal of their employment authorization to have it renewed only if the alien: (1) Continues to meet the exception noted above, (2) demonstrates economic necessity, (3) establishes that he or she warrants a favorable exercise of discretion, and (4) establishes that he or she is employed by a U.S. employer who is a participant in good standing in DHS's employment eligibility verification system (E-Verify) by providing the U.S. employer's name as listed in E-Verify and the employer's E-Verify Company Identification Number. An alien who fails to establish that he or she is employed by an E-Verify employer would not be eligible for a renewal EAD. DHS will consider an E-Verify employer to be a participant in good standing if, at the time of filing of the application for renewal of employment authorization, the employer: (1) Has enrolled in E-Verify with respect to all hiring sites in the United States that employ an alien temporarily released on an order of supervision who has received employment authorization under this rule; (2) is in compliance with all requirements of E-Verify, including but not limited to verifying the employment eligibility of newly hired employees at such hiring sites; and (3) continues to be a participant in good standing in E-Verify at any time during the employment of the alien temporarily released on an order of supervision who has received employment authorization pursuant to this rule.

- Limit the Employment Authorization Document (EAD) validity period for aliens temporarily released on orders of supervision: DHS proposes to limit the validity period for an EAD issued under 8 CFR 274a.12(c)(18) ("(c)(18) EADs") to one year, regardless of whether the alien seeks an initial or renewal EAD.

- Biometrics submission by aliens temporarily released on orders of supervision: DHS proposes to require that biometrics be submitted and a biometric services fee be paid for by aliens seeking discretionary employment authorization under 8 CFR 274a.12(c)(18) ("(c)(18) EAD applicants"). Currently, all (c)(18) EAD Start Printed Page 74198 applicants submit biometrics to USCIS[3] to, among other things, assist in identity verification and facilitate (c)(18) EAD card production. This rule proposes to codify that requirement and require that they pay a biometric services fee of $30. See proposed 8 CFR 106.2(a)(32)(i)(C).[4] In addition, DHS proposes to use biometrics submitted by (c)(18) EAD applicants to screen for criminal history. See proposed 8 CFR 241.4(j)(3).

- Provide aliens granted deferral of removal under the regulations implementing the CAT employment authorization based on the grant of deferral: Finally, DHS proposes to amend its regulations at 8 CFR 274a.12(a)(10) to include aliens who have been granted deferral of removal based on the regulations implementing the United States' obligations under the CAT[5] in the category of aliens who are not required to apply for employment authorization to work, but will be recognized as employment authorized based on the grant of deferral of removal.[6] Currently, aliens who are granted withholding of removal under section 241(b)(3) of the INA, 8 U.S.C. 1231(b)(3), or CAT under 8 CFR 208.16 and 1208.16, are employment authorized based solely on the grant of withholding. They are not required to apply for employment authorization but may obtain an EAD if they wish to have a document reflecting that they are employment authorized by virtue of the grant of withholding. However, DHS's regulations do not clearly indicate that aliens who are granted CAT deferral of removal[7] fall within the category of aliens who should be employment authorized based on the grant of deferral rather than having to apply for employment authorization like other aliens under 8 CFR 274a.12(c). DHS proposes to amend the regulations to make this clarification.

- Specify the effective date: DHS proposes to apply changes made by this rule only to initial and renewal applications filed on or after the effective date of the final rule. DHS proposes to allow aliens temporarily released on an order of supervision who are already employment authorized prior to the final rule's effective date to remain employment authorized until the expiration date on their EAD, unless their employment authorization is terminated or revoked earlier than the expiration date. USCIS would continue processing any pending application for a replacement EAD received prior to the effective date and would continue to receive new applications for replacement EADs because those adjudications are not considered a new grant of employment authorization but a replacement of an EAD based on a previously authorized period of employment prior to the effective date of the final rule.

A. Major Provisions of the Regulatory Action

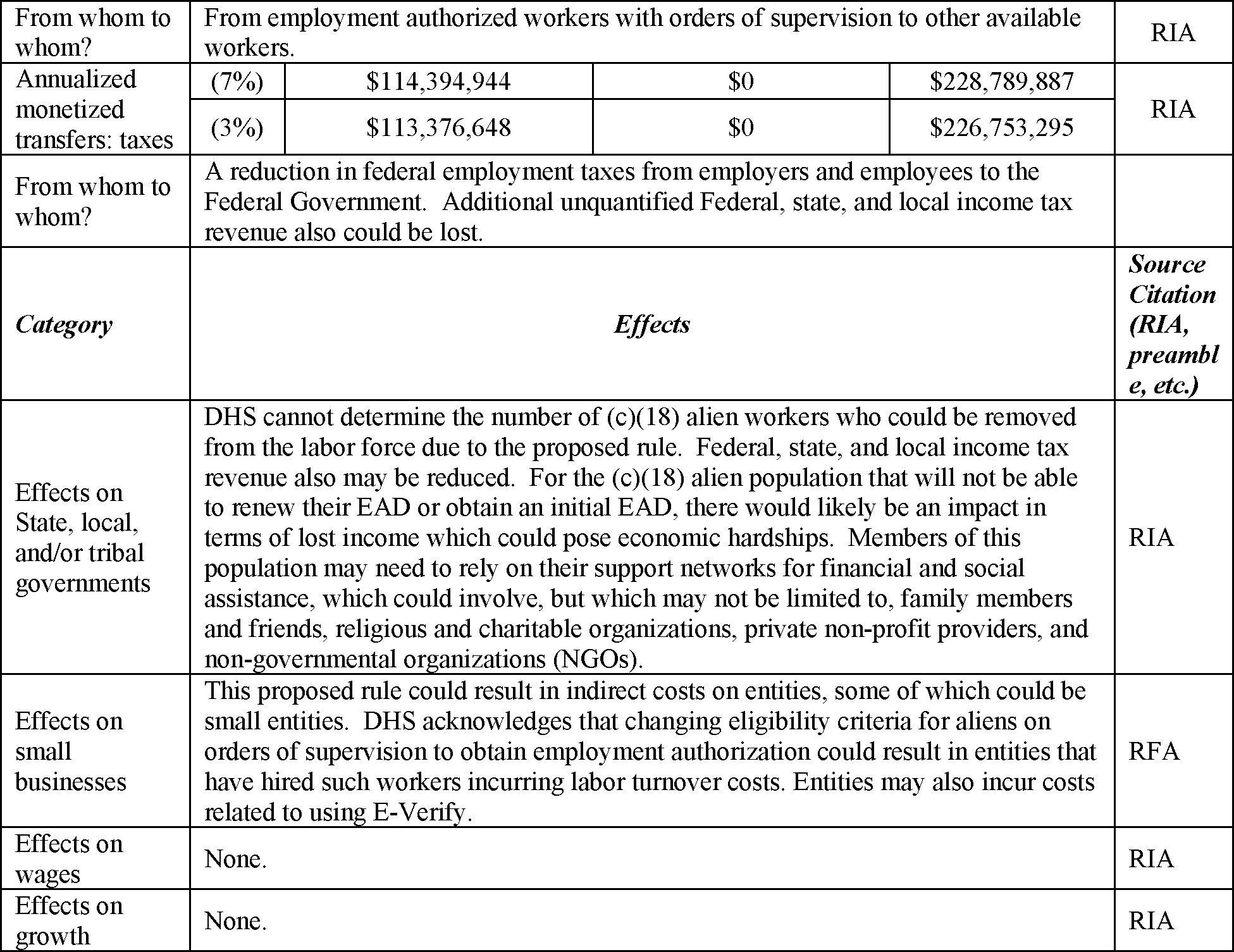

DHS proposes the following regulatory amendments:

- 8 CFR 106.2, Fees. DHS proposes to amend 8 CFR 106.2(a)(32)(i) to require that aliens who are subject to a final order of removal and temporarily released on an order of supervision pay a $30 biometric services fee in addition to the filing fee for an application for employment authorization under 8 CFR 274a.12(c)(18).

- Several provisions in subpart A of part 241. DHS is amending 8 CFR 241.4, 241.5, and 241.13 to remove obsolete references to former Immigration and Naturalization Service (INS) agency titles and replace them with the appropriate DHS component names. The amendments also update the section to correctly reflect the DHS components with authority over orders of supervision and issuance of EADs. The amendments to 8 CFR 241.4 would also codify requirements for aliens who are applying for initial and renewal employment authorization under the (c)(18) category to submit biometrics at an ASC and pay the associated biometric services fee.

- 8 CFR 274a.12, Classes of aliens authorized to accept employment. The amendments to this section clarify that 8 CFR 274a.12(a)(10) covers aliens granted withholding of removal either based on section 241(b)(3) of the INA, 8 U.S.C. 1231(b)(3), or on the regulations implementing U.S. obligations under the CAT. The amendments to this section also add aliens granted deferral of removal based on the regulations implementing CAT to the current regulation at 8 CFR 274a.12(a)(10) as aliens who are employment authorized based solely on the grant of withholding or deferral and are not required to apply for employment authorization. This section also revises 8 CFR 274a.12(c)(18) to reflect that eligibility for employment authorization based on a final order of removal and temporary release from custody on an order of supervision is limited to aliens whose removal is impracticable because all countries from whom DHS has requested travel documents have affirmatively declined to issue such documents and who establish economic necessity.

- 8 CFR 274a.13, Applications for employment authorization. This section adds a new paragraph specifically addressing the filing procedures and evidentiary requirements for aliens temporarily released from custody on an order of supervision who are seeking an initial EAD or renewing an EAD, including the new requirements to: (1) Submit the Form I-765WS, Employment Authorization Worksheet (or successor form), (2) establish the alien's economic necessity for employment, (3) provide the E-Verify Company Identification Number for the alien's U.S. employer that participates in E-Verify and the employer's name as listed in E-Verify on the application for employment authorization (renewal applicants only), and (4) submit a copy of their current U.S. Immigration and Customs Enforcement (ICE) Form I-220B, Order of Supervision (or successor form), with a copy of the complete Personal Report Record. The amendments also provide that the validity period for employment authorization under 8 CFR 274a.12(c)(18) will not exceed increments of one year.

B. Summary of Costs, Benefits, and Transfer Payments

This proposed rule is estimated to result in a reduction in the number of aliens on orders of supervision who are eligible for employment authorization, which could result in lost earnings for those no longer eligible. This loss of earnings would result in a transfer of costs from the alien to their support network, including family members, community groups, non-profits or third-party organizations to provide for the alien and any dependents. In addition, DHS estimates increased filing burdens associated with the proposed rule for those who remain eligible for employment authorization. Employers Start Printed Page 74199 that currently hire workers who would no longer be eligible to renew under this rule could experience new costs due to employee turnover and the need to comply with the proposed E-Verify requirement. Finally, the proposed rule may result in a loss of tax revenue.

Under the proposed rule, DHS anticipates there would be six types of impacts that DHS can estimate and quantify: (1) Potential lost earnings for alien workers temporarily released on orders of supervision who may no longer be eligible for employment authorization; (2) increased time burden for applicants to submit forms; (3) added time and costs for applicants to submit biometrics; (4) labor turnover costs that employers of alien workers with orders of supervision could incur when their employees' EADs expire and are not renewed; (5) costs to employers to enroll in and maintain an E-Verify account as a participant in good standing to retain workers with orders of supervision who are applying for renewal EADs; and (6) potential employment tax losses to the Federal Government.

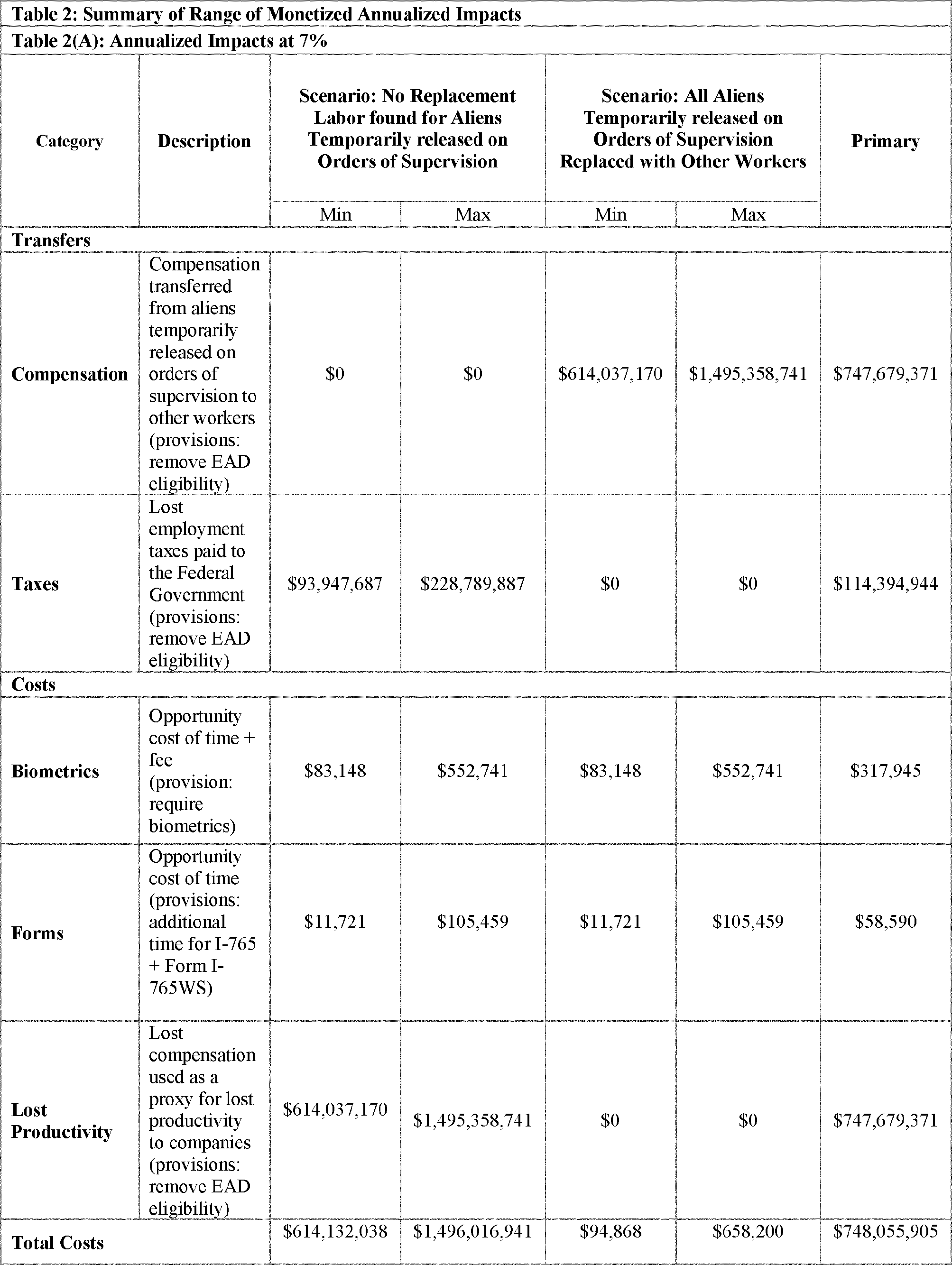

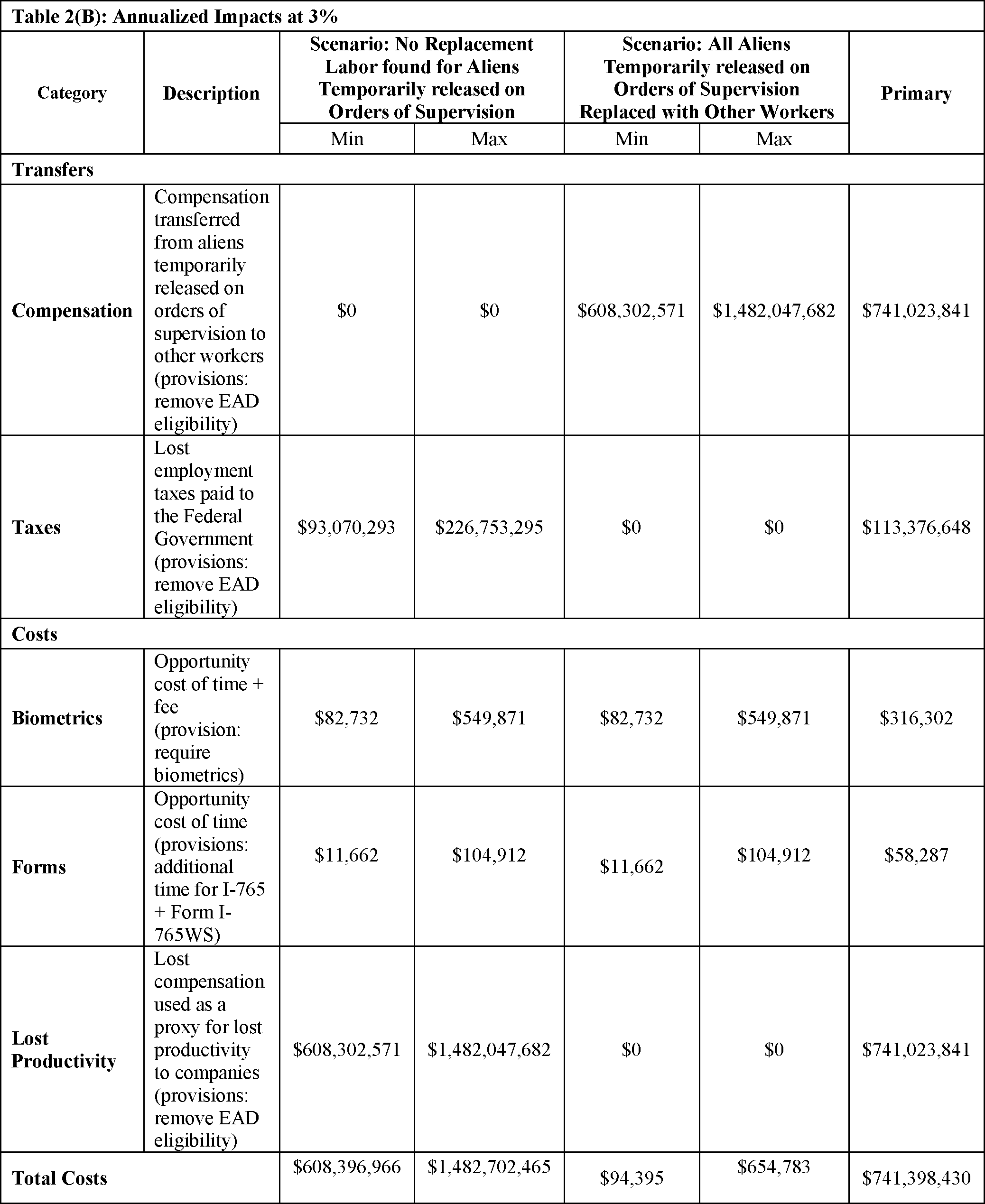

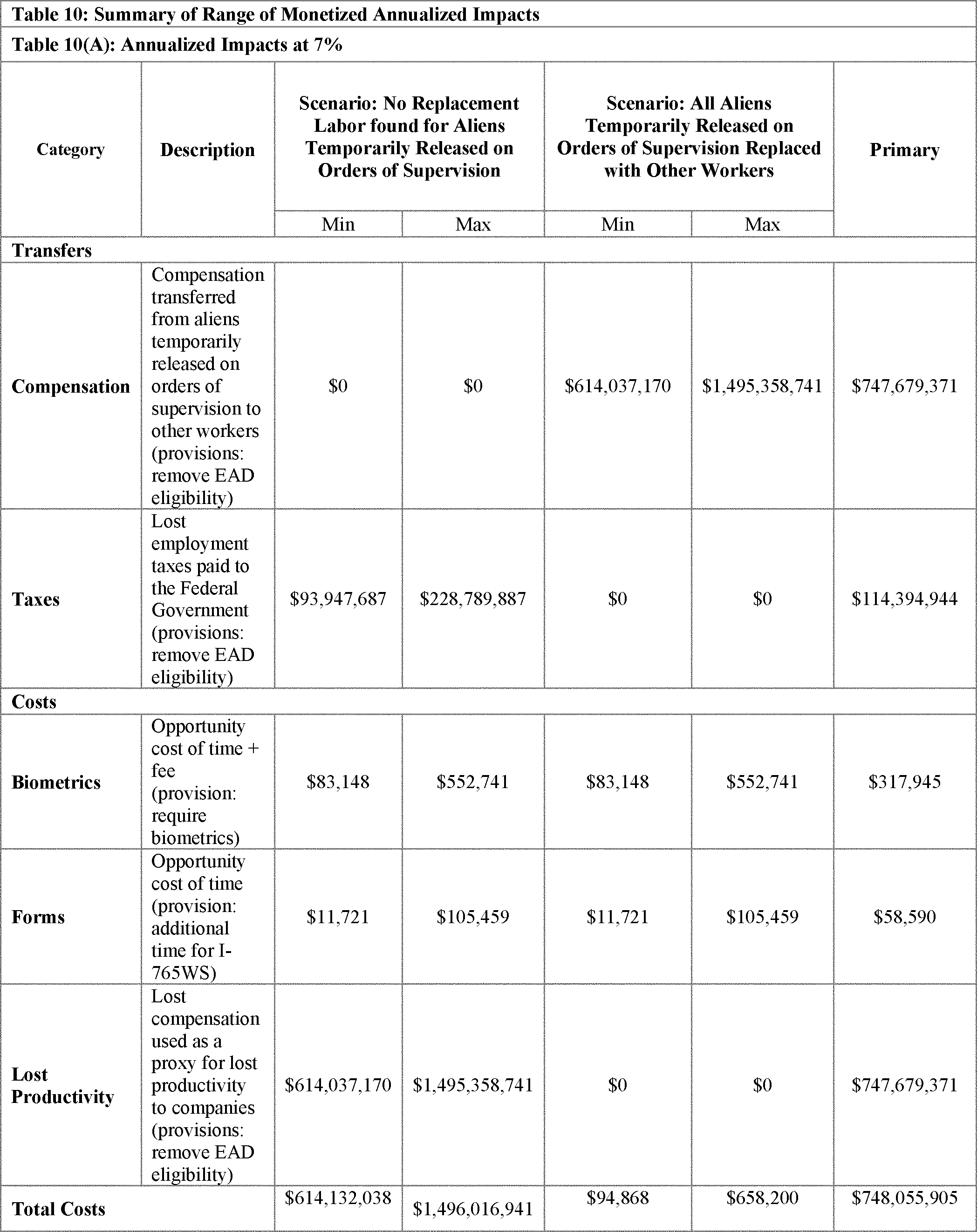

DHS estimates that some aliens with final removal orders and temporarily released on orders of supervision would be ineligible for discretionary EADs due to this proposed rule. However, DHS cannot estimate with precision what the future eligible population would be because of data constraints and, therefore, relies on a range with an upper and lower bound. The estimated costs of this proposed rule would range from a minimum of about $94,868, (annualized 7%) associated with biometrics and added burdens for relevant filing forms to a maximum of $1,496,016,941 (annualized 7%) should no replacement labor be found for aliens on orders of supervision who would be ineligible for employment authorization under this rule.[8] The ten-year undiscounted costs would range from $940,239 to $14,722,941,163. DHS estimates $228,789,887 (annualized 7%) as the maximum decrease in employment tax transfers from companies and employees to the Federal Government.

Table 1 provides a summary of the proposed regulatory changes and the estimated impacts of the proposed rule.

Start Printed Page 74200

Start Printed Page 74201

Start Printed Page 74202

The impacts of reducing the number of aliens temporarily released on orders of supervision that are eligible for EADs include both potential distributional impacts (transfers) and costs. USCIS uses the lost compensation to aliens temporarily released on orders of supervision that are no longer eligible for EADs as a measure of the impact of this change—either as distributional impacts (transfers) from these aliens to others or as a proxy for businesses' cost for lost productivity. If all companies are able to easily find reasonable labor substitutes for the positions the aliens temporarily released on orders of supervision would otherwise have filled, DHS estimates a maximum of $1,495,358,741 (annualized at 7%) would be transferred from these workers to others in the labor force (or induced back into the labor force). Under this scenario, there would be no federal employment tax losses. Conversely, if companies are unable to find reasonable labor substitutes for the position the aliens temporarily released on orders of supervision would have filled then a maximum of $1,495,358,741 (annualized 7%) is the estimated monetized cost of this provision, and $0 is the estimated monetized transfers from these aliens to other workers. In addition, under this scenario where jobs would go unfilled, there would be a loss of employment taxes to the Federal Government. USCIS estimates $228,789,887 (annualized 7%) as the maximum decrease in employment tax transfers from companies and employees to the Federal Government.

The two scenarios described above represent the estimated endpoints for the range of monetized impacts resulting from the provisions that affect employment eligibility for aliens temporarily released on orders of supervision. There are other costs of the rule, including E-Verify, biometrics, labor turnover, and additional form burdens. These costs exist under both scenarios described above, and thus $94,868 is the minimum cost of the rule (annualized 7%).

DHS is aware that the outbreak of COVID-19 will likely impact these estimates in the short run.[9] As discussed above, the analysis presents a range of impacts, depending on if companies are able to find replacement labor for the jobs alien workers temporarily released on orders of supervision would have filled. In September 2020, the unemployment rate Start Printed Page 74203 was 7.9 percent.[10] This is an improvement on April's 14.7 percent which marked the highest unemployment rate and the largest over-the-month increase in the history of the series (seasonally adjusted data are available back to January 1948).[11] By comparison, the unemployment rate for September 2019 was 3.5%.[12] DHS assumes that during the COVID-19 pandemic, with additional available labor nationally, companies are more likely to find replacement labor for the job the alien on an order of supervision would have filled.[13] Thus, in the short-run during the pandemic and the ensuing economic recovery, the lost compensation to EAD applicants as a result of this rule is likely to mean that the costs of the rule will be lower than they would otherwise have been. DHS notes that although the pandemic is widespread, the severity of its impacts varies by locality. Consequently, it is not clear to what extent the distribution of alien workers temporarily released on orders of supervision overlaps with areas of the country that will be more or less impacted by the COVID-19 pandemic. Accordingly, DHS cannot estimate with confidence to what extent the impacts will be transfers instead of costs.

DHS's assumption that all applicants with an EAD are able to obtain employment (discussed in further detail later in the analysis), also does not reflect impacts from the COVID-19 pandemic. It is not clear what level of reductions the pandemic will have on the ability of EAD holders to find jobs (as jobs are less available), or how DHS would estimate such an impact with any precision given available data. Consequently, the ranges projected in this analysis regarding lost compensation are expected to be an overestimate, especially in the short-run. The range of impacts described by the scenarios above, plus the consideration of the other costs, are summarized in Table 2 below.

Start Printed Page 74204

Start Printed Page 74205

In addition, Table 3 presents the prepared accounting statement, as required by the Office of Management and Budget (OMB) Circular A-4, showing the costs associated with this proposed regulation. Note that under costs, the primary estimates provided in the accounting statement are calculated based on the minimum cost from the scenario that all aliens temporarily released on orders of supervision are replaced with other workers and the maximum cost from the scenario that no aliens temporarily released on orders of supervision are replaced with other Start Printed Page 74206 workers (scenario presented in Tables 2(A) and (B)).

Start Printed Page 74207

The benefits potentially realized by the proposed rule are both qualitative and quantitative. Under this proposed rule, a U.S. worker may have a better chance of obtaining jobs that some (c)(18) alien workers currently hold, as the proposal would reduce employment authorization eligibility for this population of aliens who have been ordered removed from the country. Second, the proposed rule may reduce the incentive for aliens to remain in the United States after receiving a final order of removal, which could reduce the amount of government resources expended on enforcing removal orders for such aliens as well as monitoring and tracking aliens temporarily released on orders of supervision. Third, DHS clarifies that aliens granted CAT deferral of removal would no longer need to submit Form I-765 in order to become employment authorized after the effective date of the final rule. DHS estimates the total benefits for this population would range from $0 to $105,690 annually. Additional savings could also be accrued in the form of opportunity costs of time if applicants would have spent time submitting evidence under any of the (c)(18) considerations.

III. Purpose of the Proposed Rule

It is the Administration's policy to ensure the prompt removal of aliens who have been issued a final order of removal. In 2017, President Trump issued Executive Order (E.O.) 13768, "Enhancing Public Safety in the Interior of the United States," 82 FR 8799 (Jan. 25, 2017). This E.O. noted that the enforcement of our immigration laws is critically important to the national security and public safety of the United States. The continued presence in the United States of aliens with final orders of removal, many of whom are criminals who have served time in our Federal, State, and local jails and who have been determined in immigration proceedings to be ineligible to remain in the country, is contrary to the national interest. For this reason, the E.O. directed the Secretary of Homeland Security (the Secretary) to prioritize the removal of aliens from the United States who have final orders of removal and to publish new regulations revising or rescinding any regulations inconsistent with this E.O.

It is also the policy of the Administration to administer our immigration laws to create higher wages and employment rates for workers in the United States. See Exec. Order No. 13788, "Buy American and Hire American" (BAHA), 82 FR 18837 (Apr. 18, 2017). E.O. 13788 directed the Secretary to propose new rules to supersede or revise current rules to protect the interests of U.S. workers in the administration of the immigration system. Given the significant disruptions COVID-19 has caused to the U.S. economy and labor market, the President also issued Proclamation 10052, "Suspending Entry of Immigrants and Nonimmigrants Who Present a Risk to the U.S. Labor Market During the Economic Recovery following the 2019 Novel Coronavirus Outbreak" 85 FR 38263 (June 22, 2020). Proclamation 10052, among other things, requires the Secretary to take appropriate steps "to prevent certain aliens who have final orders of removal; . . . from obtaining eligibility to work in the United States." 85 FR at 38266. Start Printed Page 74208

Obtaining employment authorization in the United States has long been, and continues to be, a significant incentive for aliens to migrate to (legally and illegally) and remain in the United States. As such, employment authorization must be carefully regulated to maintain the integrity of the U.S. immigration system. Many aliens ordered removed have been released from DHS custody on OSUP because some countries unreasonably delay issuance of travel documents or due to lack of good faith efforts by the alien. In addition, because of the Supreme Court's decision in Zadvydas, DHS must release aliens within a presumptively reasonable 6-month period, which in many instances is not sufficient time for DHS to obtain the travel documents needed to remove the alien from the United States. Further, many of these aliens are criminals whose continued presence in the United States is not in the national interest. DHS has identified that providing an "open market" employment authorization to aliens with final removal orders exacerbates the challenges in effectuating removal by incentivizing such aliens to remain in the United States and possibly compete for jobs against U.S. workers instead of complying with their removal orders, working with the country of removal to obtain travel documents in a timely manner, and departing the United States.

Through this proposed rule, DHS seeks to promote the integrity of the immigration system by eliminating discretionary employment authorization for those who have a final order of removal and encouraging their efforts to obtain travel documents in timely manner and depart the United States. The proposed rule would also help strengthen protections for U.S. workers and minimize the risk of disadvantaging U.S. workers, especially as the U.S. economy and the labor market recover from the significant disruptions caused by the COVID-19 pandemic.

A. Enforcement Priorities

Enforcement of the nation's immigration laws is essential to the integrity of the immigration system. It ensures that only those who are legally qualified and lawfully in the United States are allowed to avail themselves of any benefits under the INA. In 1996, Congress passed the Anti-Terrorism and Effective Death Penalty Act (AEDPA), Public Law 104-132, title IV; 110 Stat. 1214 (Apr. 24, 1996) and the Illegal Immigration Reform and Immigrant Responsibility Act of 1996 (IIRIRA), Public Law 104-208, div. C; 110 Stat. 3009 (Sept. 28, 1996). AEDPA and IIRIRA made sweeping changes to U.S. immigration laws focusing on immigration enforcement, detention of aliens, and bars to certain types of relief or protection from removal and grants of legal status. IIRIRA expanded the Attorney General's (now Secretary's) authority[14] to detain aliens, including requiring mandatory detention of aliens convicted of aggravated felony offenses and the detention of aliens pending removal from the United States. It also created an expedited removal process for aliens seeking admission into the United States who do not have proper documents or who make material misrepresentations, and, as designated by the Secretary, aliens who have not been inspected and admitted or paroled into the United States and cannot prove they have been in the United States for at least two years.[15] By passing AEDPA and IIRIRA, Congress made clear that enforcement of the immigration laws is a priority and is critical for purposes of national security, public safety, and the integrity of the U.S. immigration system.

Unfortunately, DHS is not always able to promptly remove aliens with final orders of removal. Sections 241(a)(1) and (2) of the INA, 8 U.S.C. 1231(a)(1), (2), provide for a 90-day removal period in which the Secretary is authorized to detain the alien and within which the Secretary shall remove the alien. However, the removal of aliens from the United States and repatriation[16] to their home countries can be a difficult and time-consuming process that can be further complicated and impeded by a lack of sufficient agency resources or legal constraints. Delays in removal also can occur because some countries unreasonably delay the issuance of travel documents, or unreasonably delay accepting the repatriation of their nationals.[17] Based on data on removals executed by DHS, it may take DHS 6 months or longer to obtain travel documents and remove an alien from the United States. For example, in Fiscal Year (FY) 2017, the average time for DHS to remove an alien who had a final order and was temporarily released on an order of supervision was 321.39 days.[18] However, in FY 2018, the number of days it took DHS to remove an alien who had a final order and was temporarily released on an order of supervision decreased to just over 6 months (average time to remove was 187.19 days).[19]

While DHS has authority to detain aliens with final orders of removal during the removal period, if DHS cannot effectuate an alien's removal in a presumptively reasonable 6-month removal period, DHS must generally release such aliens from detention. See generally Zadvydas v. Davis, 533 U.S. 678 (2001).[20] Due to the U.S. Supreme Court's decision in Zadvydas, DHS has had to release thousands of aliens from detention as illustrated in Table 4, including aliens convicted of aggravated felonies and other serious crimes.

| Category | FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

|---|---|---|---|---|---|

| Convicted Criminals21 | 3,692 | 3,179 | 2,815 | 4,233 | 5,269 |

| Pending Criminal Charges | N/A | N/A | N/A | 431 | 993 |

| Other Immigration Violator | 3,080 | 4,381 | 3,502 | 7,748 | 7,504 |

| Total | 6,772 | 7,560 | 6,317 | 12,412 | 13,766 |

| Note: In FY 2018, ICE redefined categorization of immigration violator's criminality. Therefore, the categories changed from "criminal" and "noncriminal" to "convicted criminal alien," "pending criminal charges," and "other immigration violators." | |||||

| * Data from ICE Enforcement and Removal Operations, Law Enforcement Systems and Analysis (ERO, LESA) (FY 2015 to FY 2019). | |||||

Start Printed Page 74209

When aliens with final removal orders are released from DHS custody, they are released on orders of supervision. These orders of supervision contain conditions for release, such as requiring aliens to assist with efforts to procure travel documents and present themselves for removal in the event removal can be arranged. Once temporarily released on an order of supervision, an alien may apply for employment authorization under 8 CFR 274a.12(c)(18). Each year, USCIS approves thousands of initial requests for employment authorization and renewals of such authorization for aliens released from DHS custody on orders of supervision as shown in Table 5.

| Category | FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

|---|---|---|---|---|---|

| Initials | 8,748 | 7,499 | 5,273 | 3,433 | 4,071 |

| Renewals | 21,236 | 24,464 | 21,274 | 20,151 | 21,350 |

| * Data obtained from the USCIS Office of Performance and Quality (OPQ). | |||||

As noted above, E.O. 13768 made the prompt removal of aliens ordered removed a priority for the Administration and directed the Secretary to publish new regulations revising or rescinding any regulations that are inconsistent with the E.O. As a result of its regulatory review, DHS examined the current regulation at 8 CFR 274a.12(c)(18) governing employment eligibility for aliens with a final removal order and temporarily released on orders of supervision. DHS determined that this regulation is inconsistent with the Administration's enforcement priorities because it allows virtually any alien temporarily released on an order of supervision to qualify for employment authorization and, as such, incentivizes such aliens to remain in the United States instead of complying with their removal order and departing the United States.

The current regulation simply restates the language of INA section 241(a)(7), 8 U.S.C. 1231(a)(7) and does not clearly place the burden on the alien to establish that he or she warrants a favorable exercise of discretion to obtain employment authorization. It also does not require an alien who has a final order of removal and has been temporarily released on an order of supervision to clearly establish on what basis he or she is seeking employment authorization, either under INA section 241(a)(7)(A), because every country designated by the alien or under that section has refused to receive the alien, or under INA section 241(a)(7)(B), because removal is impracticable or against the public interest. The burden is on the alien, not the U.S. Government, to establish that he or she is eligible for a discretionary benefit. Further, the current regulation does not put the public on notice of when DHS will deem the removal of an alien to be impracticable or what DHS has determined to be in the public interest for the purpose of granting employment authorization to aliens with final orders of removal.

As previously stated, the ability to obtain employment authorization provides aliens a significant motivation to remain in the United States. DHS has determined that providing employment authorization to aliens who have final orders of removal, except in very limited circumstances, undermines the removal scheme created by Congress and incentivizes such aliens to remain in the United States instead of complying with their removal orders, working with the country of removal to obtain travel documents in a timely manner, and departing the United States. The revisions under this proposed rule will address these concerns and align the issuance of employment authorization with the Administration's enforcement priorities.

B. Strengthening Protections for U.S. Workers

DHS also wants to ensure that any discretionary grant of employment authorization to aliens is consistent with the Administration's efforts to strengthen protections for U.S. workers and minimize the risk of disadvantaging U.S. workers.

As noted above, E.O. 13788 directed DHS to propose new rules to supersede or revise current rules to protect the interests of U.S. workers[22] in the administration of the immigration system. More recently, the President issued Proclamation 10052, which describes that significant disruptions COVID-19 has caused to the U.S. economy and the detrimental impact of foreign workers on the U.S. labor market during the high domestic unemployment. To address this concern, Proclamation 10052, in addition to suspending the entry of certain immigrants and nonimmigrants into the United States, requires the Secretary to take appropriate steps to prevent certain aliens who have final orders of removal from obtaining eligibility to work in the United States.

This proposed rule aligns with the Administration's goals of protecting U.S. workers in the labor market, particularly as the economy recovers from the extraordinary disruptions resulting from the COVID-19 outbreak. The U.S. unemployment rose to a record high of 14.7 percent in April 2020[23] but declined to 7.9 percent in September.[24] However, it remains above 3.5%, which was unemployment rate for the same month last year (i.e., September 2019).[25] DHS asserts it is likely that some aliens with final orders of removal and temporarily released on an order of supervision may compete for, and potentially occupy, jobs that U.S. workers might have applied for and been offered, particularly during this period of high unemployment. Aliens temporarily released on an order of supervision who apply for employment authorization under the current regulatory scheme receive an "open market" EAD, meaning they may accept employment in any field and may be hired by any U.S. employer without the U.S. employer having to demonstrate that there were no available U.S. Start Printed Page 74210 workers or to guarantee that it will pay the prevailing wage or maintain certain work conditions.

C. Exception to Employment Authorization Bars

DHS recognizes that there are certain times an alien cannot be removed from the United States because DHS is unable to obtain travel documents from a country of removal. Therefore, DHS is proposing to create a narrow exception to the bar to employment authorization. DHS will continue to allow aliens who are subject to a final order of removal to apply for discretionary employment authorization if (1) DHS has determined that their removal is impracticable because all countries from whom DHS has requested travel documents have affirmatively declined to issue such documents and (2) the aliens establish economic necessity.

DHS anticipates that the number of aliens who are subject to a final order of removal for whom DHS has determined that their removal is impracticable will be relatively small. For example, in FY 2019, only about 4.8 percent (659) of aliens who were temporarily released on an order of supervision (13,766) could not be removed in that fiscal year due to DHS's inability to obtain travel documents during the fiscal year in which the aliens were counted (Table 6).[26] Additionally, the percentage of aliens for whom DHS cannot obtain travel documents has averaged about 5 percent of aliens temporarily released on an order of supervision since FY 2015. DHS believes that the number of aliens who would qualify for this exception will remain small because even after an alien is temporarily released on an order of supervision, DHS continues to work with the foreign governments to obtain travel documents and DHS sometimes receives travel documents for such aliens shortly after their release or within the following fiscal year.

| Fiscal year | Total number of aliens temporarily released on an order of supervision | Number of aliens on an order of supervision for whom DHS could not obtain travel docs | Approximate percentage of total (%) |

|---|---|---|---|

| 2015 | 6,772 | 369 | 5.4 |

| 2016 | 7,560 | 411 | 5.4 |

| 2017 | 6,317 | 324 | 5.1 |

| 2018 | 12,412 | 530 | 4.3 |

| 2019 | 13,766 | 659 | 4.8 |

| Average of During 5-Fiscal Year Period | 9,365 | 459 | 4.9 |

| * Data from ICE ERO, LESA Statistical Tracking Unit (FY 2015 to FY 2019). | |||

Finally, DHS believes that allowing aliens who fall within the exception to be eligible for employment authorization is consistent with section 241(a)(7) of the INA, 8 U.S.C. 1231(a)(7). Section 241(a)(7) of the INA, 8 U.S.C. 1231(a)(7), bars employment authorization for aliens who have been ordered removed. No alien subject to a final order of removal has a right to apply for or obtain employment authorization from USCIS under U.S. law. Section 241(a)(7) of the INA, however, gives the Secretary the authority to grant employment authorization if the Secretary determines that: (1) An alien cannot be removed from the United States because all countries of removal as designated by the alien or delineated under section 241 of the INA, 8 U.S.C. 1231, have refused to receive the alien, or (2) the alien's removal is impracticable or contrary to the public interest. INA section 241(a)(7)(A) and (B), 8 U.S.C. 1231(a)(7)(A) and (B). The Secretary is not required to make a finding under either subparagraph (A) or (B) of section 241(a)(7) of the INA, 8 U.S.C. 1231(a)(7)(A), (B), nor is the Secretary required to make a specific finding under either clauses of subparagraph (B) (i.e. "otherwise impracticable" or "contrary to the public interest"). The Secretary can choose to maintain the permanent bar on employment authorization for all aliens subject to a final order of removal without further action.

In this rulemaking, DHS is not making any findings under subparagraph (A). DHS does not believe any findings under subparagraph (A) are necessary or required because, consistent with the Administration's enforcement priorities, all aliens who have a final order of removal will be subject to removal from the United States, either to a country where the alien is a citizen, subject, or national, the alien was born, or the alien has a residence, or to any country that is willing to accept the alien.

DHS also is not making any findings or creating an exception based on the "public interest" clause of subparagraph (B) because other avenues for employment eligibility already exist for aliens whom DHS determines that their removal is contrary to the public interest. For example, when an alien with a final order of removal is actively assisting law enforcement entities, and the alien's removal is contrary to the public interest because of such assistance, there are avenues for such aliens to qualify for employment authorization, in part, based on their assistance to law enforcement. Such aliens assisting law enforcement may qualify for employment authorization if they are eligible for T non-immigrant status (trafficking victims),[27] U non-immigrant status (victims of criminal activity),[28] and S non-immigrant status (witnesses in criminal investigations or prosecutions).[29] These existing avenues reflect the public interest in strengthening cooperation with law enforcement and provide DHS with the appropriate framework to assess the nature of the alien's assistance to law enforcement.

Therefore, except for aliens for whom the Secretary has made a finding under the impracticability clause of section 241(a)(7)(B) of the INA, 8 U.S.C. 1231(a)(7)(B), no other alien with a final Start Printed Page 74211 order of removal who has been temporarily released on an order of supervision will be eligible for employment authorization. This includes aliens who may have previously been eligible for employment authorization based on the public interest clause of section 241(a)(7)(B) of the INA, 8 U.S.C. 1231(a)(7)(B), or based section 241(a)(7)(A) of the INA, 8 U.S.C. 1231(a)(7)(A). Furthermore, for purposes of determining employment eligibility only, DHS further clarifies that an alien's removal is "otherwise impracticable" under section 241(a)(7)(B) of the INA when DHS determines that all countries from whom DHS has requested travel documents have affirmatively declined to issue a travel document.

DHS believes that exercising its discretionary authority as provided in this proposed rule promotes the protection of U.S. workers while ensuring the faithful execution and enforcement of the immigration laws.

IV. Background

A. Legal Authority

DHS's authority to detain and release from custody aliens subject to final orders of removal on orders of supervision and to grant employment authorization is found in several statutory provisions. Section 102 of the Homeland Security Act of 2002 (HSA) (Pub. L. 107-296, 116 Stat. 2135), 6 U.S.C. 112 and section 103 of the INA, 8 U.S.C. 1103, charge the Secretary with the administration and enforcement of the immigration and naturalization laws of the United States.[30] In addition to establishing the Secretary's general authority to administer and enforce immigration laws, section 103 of the INA enumerates various related authorities including the Secretary's authority to establish regulations necessary for carrying out his authority. Section 241 of the INA, 8 U.S.C. 1231, governs the detention, release, and removal of aliens after they have received an administratively final order of removal. Section 274A of the INA, 8 U.S.C. 1324a, governs employment of aliens who are authorized to be employed by statute or in the discretion of the Secretary and the requirements U.S. employers must follow to verify the identity and employment authorization of their employees. The authority to establish and operate E-Verify is found in sections 401-405 of IIRIRA, Public Law 104-208, 110 Stat. 3009-546. The Secretary proposes the changes in this rule under these authorities.

B. Detention and Release of Aliens Ordered Removed

Section 241 of the INA, 8 U.S.C. 1231, governs the detention, release, and removal of aliens who are subject to final orders of removal.[31] When an alien is issued a final order of removal, DHS generally has 90 days after issuance of the final order of removal to remove the alien from the United States.[32] This 90-day removal period can be extended if the alien fails or refuses to make timely application in good faith for travel or other documents necessary for the alien's departure or conspires or acts to prevent removal.[33] Section 241(a)(2) of the INA, 8 U.S.C. 1231(a)(2), requires detention during the removal period and specifically prohibits DHS from releasing an alien who has been found inadmissible under sections 212(a)(2) or 212(a)(3)(B), 8 U.S.C. 1182(a)(2), (a)(3)(B), or deportable under sections 237(a)(2) or 237(a)(4)(B) of the INA, 8 U.S.C. 1227(a)(2), (a)(4)(B).

In certain instances, DHS is not able to remove aliens within the 90-day period after issuance of the final order of removal. In such cases, DHS must comply with the U.S. Supreme Court's decision in Zadvydas. [34] In Zadvydas, the U.S. Supreme Court held that an alien with a final order of removal cannot be kept in detention (unless special circumstances exist)[35] once it has been determined that there is not a "significant likelihood of removal in the reasonably foreseeable future."[36] The Court established six months as the "presumptively reasonable period of detention." After the six-month period, once the alien provides good reason to believe there is no significant likelihood of removal in the reasonably foreseeable future, the Government must respond with sufficient evidence to rebut that showing.[37] In the event DHS determines that removal is not likely to occur in the reasonably foreseeable future, the alien must generally be temporarily released on an order of supervision. During this period of release, the alien is required to continue to make efforts (or assist in efforts) towards his or her removal, and DHS will continue to pursue the alien's removal.[38]

If an alien is temporarily released on an order of supervision, the order of supervision will contain conditions for release including requiring the alien to appear periodically before an immigration officer and comply with the conditions prescribed in the order of supervision.[39] INA section 241(a)(3), 8 U.S.C. 1231(a)(3); 8 CFR 241.5(a). If an alien fails to comply with the conditions for release as specified in the order of supervision, DHS can take the alien back into custody and detain the alien until he or she is removed. Aliens who willfully fail to comply with an order of supervision can also be criminally prosecuted under section 243(b) of the INA, 8 U.S.C. 1253(b).

C. Repatriation of Aliens Ordered Removed

Once an alien has been issued a final order of removal, ICE is responsible for effectuating the alien's removal from the United States pursuant to section 241 of the INA, 8 U.S.C. 1231, and 8 CFR 241. Generally, a travel document must be obtained from a foreign government that will allow the alien to depart the United States and be repatriated either to the alien's country of birth, citizenship, nationality, or last habitual residence or to an alternate country that has agreed to accept the alien. As indicated earlier, based on data on removals for FY 2018, it takes DHS an average of a little over 6 months to obtain travel documents and remove an alien from the United States.[40]

However, obtaining travel documents is not always easy. Some countries refuse or unreasonably delay the issuance of the necessary travel documents to aliens who have been issued a final order of removal. Countries that unreasonably delay Start Printed Page 74212 accepting the repatriation of their citizens or nationals impede DHS's ability to remove the alien in a timely manner and interfere with the United States' sovereign interest in enforcing its immigration laws. Under section 243(d) of the INA, 8 U.S.C. 1253(d), the Secretary has the authority to notify the Secretary of State that a specific country is refusing or unreasonably delaying acceptance of its nationals. Upon such notification from the Secretary, the Secretary of State shall order consular officers in that country to discontinue issuing immigrant visas, nonimmigrant visas, or both to citizens and nationals of that country.[41] While DHS and DOS work through various diplomatic channels and avenues to get such countries to comply, and most countries do comply, there are countries that refuse to assist in the repatriation of their citizens and nationals, and as a result, the United States has imposed visa sanctions under section 243(d) of the INA, 8 U.S.C. 1253(d), to get such countries to cooperate.[42]

D. Withholding of Removal Under the INA and Regulations Implementing CAT and Deferral of Removal Under Regulations Implementing CAT

Even if the alien is inadmissible or deportable and has a final order of removal, DHS's ability to remove an alien in certain cases is further restricted by U.S. treaty obligations. The United States is a party to the 1967 Protocol relating to the Status of Refugees (Protocol), which incorporates, inter alia, Article 33 of the 1951 Convention relating to the Status of Refugees. 198 U.N.T.S. 137. Article 33 specifically provides that "[n]o contracting state shall expel or return (refouler) a refugee in any manner whatsoever to the frontier of territories where his life or freedom would be threatened on account of his race, religion, nationality, membership of a particular social group, or political opinion."[43] The United States is also a party to the CAT. Article 3 of the CAT requires that "[n]o State Party shall expel, return (`refouler') or extradite a person to another state where there are substantial grounds for believing that he would be in danger of being subjected to torture."[44]

Though neither of these treaties is self-executing, the United States has implemented its non-refoulement obligations under them in statute and regulations. With respect to the Protocol, Congress implemented the United States' non-refoulement obligations as part the Refugee Act of 1980, section 241(b)(3) of the INA, 8 U.S.C. 1231(b)(3). With respect to the CAT, Congress directed the appropriate agencies to publish regulations to implement the United States' obligations under Article 3 of the CAT in the Foreign Affairs Reform and Restructuring Act of 1988 (FARRA), Public Law 105-277, Div. G., § 2442(b) (Oct. 21, 1998). DOJ published regulations in 1999 implementing FARRA § 2442. See 64 FR 8478-01 (1999). The regulations governing withholding of removal based on section 241(b)(3) of the INA, 8 U.S.C. 1231(b)(3), and CAT are now codified at 8 CFR 208.16 through 208.18 and 8 CFR 1208.16 through 1208.18.

Aliens granted withholding of removal based on section 241(b)(3) of the INA, 8 U.S.C. 1231(b)(3), as well as aliens granted withholding of removal based on the regulations implementing CAT, 8 CFR 208.16(c), are both subject to mandatory bars to withholding if the alien participated in the persecution of others, is a human rights violator, or has been convicted of a particularly serious crime.[45] However, even if an alien is not eligible for withholding under the provisions noted above because he or she is subject to one of the mandatory bars to withholding, DHS still is not permitted to remove an alien from the United States if an IJ or the Board of Immigration Appeals (BIA) has determined that removal would result in the alien being removed to a country where he or she would more likely than not be tortured. 8 CFR 208.17 and 1208.17. In such instances, the IJ or BIA defers removal to that country.

Withholding of deportation or removal based on section 241(b)(3) of the INA, 8 U.S.C. 1231(b)(3), or the regulations implementing CAT (if the alien is not subject to a mandatory bar) and CAT deferral of removal are mandatory and must be granted if the alien meets the burden of proof. See 8 CFR 208.16(c)(4) and 208.17(a). Once an alien has been granted withholding of removal or deferral of removal, DHS cannot remove the alien to the country from which removal has been withheld or deferred unless the alien's case is reopened and withholding is terminated under 8 CFR 208.24 or 1208.24, or deferral is terminated under 8 CFR 208.17 or 1208.17. In most instances an alien granted withholding of removal or deferral of removal under the regulations implementing CAT will be released pursuant to an order of supervision, but such an order does not alter or affect the nondiscretionary nature of the withholding or deferral of removal grant, even if the alien subsequently violates the conditions for release as specified in the order of supervision. Such violations could result in a return of the alien to ICE custody but will not result in the alien's actual removal from the United States unless the alien's case is reopened and withholding is terminated under 8 CFR 208.24 or 1208.24, or deferral is terminated under 8 CFR 208.17 or 1208.17.

E. Employment Authorization

Whether an alien is authorized to work in the United States depends on the alien's status in the United States and whether employment is specifically authorized by statute or only authorized pursuant to the Secretary's discretion. There are very few statutory provisions that require the Secretary to grant employment authorization.[46] While some statutory provisions specifically allow the Secretary to grant employment authorization as a matter of discretion,[47] the Secretary's general authority under section 274A(h)(3) of the INA, 8 U.S.C. Start Printed Page 74213 1324a(h)(3), is used to establish most discretionary employment authorization categories. However, in the context of aliens ordered removed, section 241(a)(7) of the INA, 8 U.S.C. 1231(a)(7), specifically prohibits an alien who has been ordered removed from the United States from being eligible to receive employment authorization unless the Secretary determines that the alien cannot be removed because no country, as designated by the alien or delineated under section 241(b) of the INA, 8 U.S.C. 1231(b), will accept the alien or the alien's removal is impracticable or contrary to the public interest.

DHS regulations at 8 CFR 274a.12 set forth the categories of aliens who are authorized to work in the United States, including; those aliens who are authorized to work incident to their status (8 CFR 274a.12(a)); aliens who are authorized to work in the United States but only for a specific employer (8 CFR 274a.12(b)); and aliens who fall within a category that the Secretary has determined may be employment authorized as a matter of discretion (8 CFR 274a.12(c)). Aliens seeking employment authorization generally must file an application with USCIS with the appropriate fee (unless waived) and in accordance with the form instructions. See 8 CFR 274a.13.

F. Biometric Submission

Current DHS regulations provide general authorities for USCIS to require the submission of biometrics in connection with immigration benefits. See 8 CFR 103.2(b)(9). DHS has the authority to require the submission of biometrics from any applicant, petitioner, sponsor, beneficiary, or requestor, or individual filing a request, on a case-by-case basis, through form instructions, or by a Federal Register notice. See 8 CFR 103.16. Current regulations allow DHS to use the biometric information to conduct background and security checks, adjudicate immigration benefits, and perform other functions related to the administration of the INA. See id. DHS is also authorized to charge a biometric services fee associated with the submission of biometric information. See 8 CFR 103.17.

V. Discussion of the Proposed Rule

A. Eligibility for Employment Authorization for Aliens on Orders of Supervision

Section 241(a)(7) of the INA, 8 U.S.C. 1231(a)(7), specifically prohibits an alien who has been ordered removed from the United States from being eligible to receive employment authorization unless the Secretary, in the Secretary's discretion, determines, under subparagraph (a)(7)(A), that the alien cannot be removed because no country, as designated by the alien or delineated under section 241(b) of the INA, 8 U.S.C. 1231(b), will accept the alien or, under subparagraph (a)(7)(B), 8 U.S.C. 1231(a)(7)(B), the alien's removal is impracticable or contrary to the public interest. Neither the INA nor the regulations mandate issuance of employment authorization for any alien subject to a final order of removal or based on such alien's temporary release from custody on an order of supervision. The statute preserves the Secretary's discretion to decide if employment authorization should be granted and, if yes, to which classes of aliens based upon a finding under subparagraph (A) or (B) of section 241(a)(7) of the Act, 8 U.S.C. 1231(a)(7)(A), (B).

DHS is proposing to amend 8 CFR 274a.12(c)(18) to eliminate eligibility for employment authorization for all aliens who have final orders of removal and are temporarily released from custody on an order of supervision except for aliens for whom DHS has determined that their removal from the United States is impracticable because all countries from whom DHS has requested travel documents have affirmatively declined to issue such documents. See proposed 8 CFR 274a.12(c)(18). Providing EADs to aliens who do not fall within this exception undermines the integrity of the immigration system by incentivizing aliens with a final removal order to remain in the United States instead of complying with their removal orders, obtaining travel documents in a timely manner, and departing the United States.

Encouraging aliens who do not fall within the exception provided in this rule to timely depart the United States also promotes the efficient use of DHS's limited resources. Managing the vast number of aliens on OSUP consumes an inordinate amount of DHS resources. Management of aliens temporarily released on OSUP requires tracking and monitoring the status of such aliens, as well as conducting regular check-ins to ensure compliance with the conditions of release. This time intensive process takes away from other enforcement priorities such identifying, detaining, and removing criminal aliens. The proposed rule also aligns with the Administration's goals of strengthening protections for U.S. workers in the labor market. It helps strengthen protections for U.S. workers and minimize the risk of disadvantaging U.S. workers, especially as the economy and the labor market recovers from the significant disruptions caused by the COVID-19 pandemic.

DHS has determined that continuing to provide employment authorization to those aliens who fall within the exception provided in this rule is consistent with the impracticability clause of INA section 241(a)(7)(B), 8 U.S.C. 1231(a)(7)(B). Table 7 below shows the number of aliens for whom DHS cannot obtain travel documents annually out of the total number of aliens removed from the United States.

| Fiscal year | Total number of aliens removed from the United States | Number of aliens on orders of supervision for whom DHS could not obtain travel docs to execute removal from the United States |

|---|---|---|

| 2015 | 235,413 | 369 |

| 2016 | 240,255 | 411 |

| 2017 | 226,119 | 324 |

| 2018 | 256,085 | 530 |

| 2019 | 267,258 | 659 |

| Average over 5-Fiscal Year Period | 245,026 | 459 |

| * Data from ICE ERO, LESA Statistical Tracking Unit (FY 2015 to FY 2019). | ||

Start Printed Page 74214

In some instances, even if DHS is not able to obtain travel documents for an alien in one fiscal year, DHS is able to obtain such documents in a subsequent fiscal year. DHS expects the number of aliens whose removal from the United States is impracticable because all countries from whom DHS has requested travel documents have affirmatively declined to issue such documents will remain very low. As such, DHS has determined that it is not contrary to the INA or the Administration's enforcement priorities to allow such aliens to work while they remain in the United States and until they can be removed.

For aliens whose removal from the United States is impracticable, DHS is proposing to make economic necessity, which is currently only a discretionary factor, a mandatory eligibility requirement, consistent with other discretionary employment authorization categories. See, e.g., 8 CFR 274a.12(c)(14). As such, aliens who are eligible to apply for employment authorization based on the exception created in this proposed rule will need to demonstrate economic necessity for employment during the period they are on an order of supervision. Aliens who are financially able to support themselves during the period prior to their removal from the United States will not be eligible for an EAD. Furthermore, to protect U.S. workers against potential displacement or any disadvantages in the labor market, including during the current economic recovery, DHS wants to ensure that U.S. employers who hire aliens who are temporarily released on an order of supervision are complying with our immigration laws and not employing unauthorized workers. For this reason, DHS is proposing to require aliens on an order of supervision who are seeking a renewal of their employment authorization be employed by a U.S. employer who is a participant in good standing in the E-Verify program.

DHS proposes to limit the validity period for employment authorization under 8 CFR 274a.12(c)(18), whether the alien seeks an initial or renewal EAD, to a period not to exceed increments of one year.

B. USCIS Evidentiary Requirements

DHS proposes to require aliens temporarily released on orders of supervision who are eligible to apply for employment authorization under the new criteria and who are seeking initial employment authorization or a renewal to submit an Application for Employment Authorization, (Form I-765) with the appropriate fee, including the biometric services fee, and in accordance with the form instructions. See proposed 8 CFR 274a.13(a)(3). DHS also proposes to require such aliens to submit the following additional documents: (1) A copy of a decision by an IJ or the BIA, or an administrative removal order issued by DHS demonstrating that the alien is subject to a final order of removal or deportation; (2) a completed Employment Authorization Worksheet (Form I-765WS) to show economic necessity;[48] and (3) a copy of the current and complete Order of Supervision (Form I-220B), including a copy of the complete Personal Report Record which reflects compliance with the conditions for release.

Given that ICE is the primary DHS component with jurisdiction over the detention and removal of aliens with a final removal order, ICE will make the appropriate determination as to whether the alien's removal is impracticable at the time of the alien's initial temporary release on an order of supervision and thereafter when the alien is required to report to ICE consistent with the conditions of release. If ICE determines all countries from whom DHS has requested travel documents have affirmatively declined to issue such documents, ICE officers will annotate the Form I-220B to indicate that the alien's removal is currently impracticable because of the reasons stated above. Aliens with final removal orders who are temporarily released on an order of supervision and who are seeking employment authorization based on this exception would not be eligible to apply for employment unless ICE has made such a determination and annotated the Form I-220B to indicate the alien's removal is impracticable because of the reasons stated above.

In addition to the above, DHS proposes to require aliens on orders of supervision who apply for initial employment authorization after the effective date of the final rule and who subsequently seek renewal of their employment authorization to: (1) Show that they meet the exception, (2) demonstrate economic necessity by submitting a completed Employment Authorization Worksheet (Form I-765WS), and (3) show that they are employed by a U.S. employer who is a participant in good standing in E-Verify (renewals only) by providing their U.S. employer's E-Verify Company Identification Number and the employer's name as listed in E-Verify on their application for employment authorization. Id. An alien who fails to establish that he or she is employed by an E-Verify employer at the time of filing or adjudication of the application to renew his or her employment authorization is ineligible for an EAD. Furthermore, for both initial and renewal EAD applications, DHS will determine if the alien warrants a favorable exercise of discretion to grant employment authorization. To this end, aliens may include supporting documentation of favorable factors as part of the EAD application.

C. Biometric Submission and Criminal History

Currently, all (c)(18) applicants receive an appointment notice from USCIS to submit their biometrics so USCIS can use them for identity verification and EAD production. DHS proposes to codify this biometric submission and associated biometric services fee for aliens seeking discretionary employment authorization under the (c)(18) category. See proposed 8 CFR 241.4(j)(3).

In addition, DHS also proposes to use the (c)(18) applicant's biometrics to screen for criminal history. DHS has a strong interest in ensuring public safety and preventing aliens with significant criminal histories from obtaining a discretionary benefit. As such, for aliens who fall within the exception provided in this proposed rule and meet the economic necessity requirement, DHS is proposing to consider a (c)(18) applicant's criminal history in determining whether DHS will favorably exercise its discretion to grant an employment authorization. Where criminal history is a factor in the adjudication of an immigration benefit, DHS typically conducts biometric-based screening to independently identify and verify criminal history in addition to reviewing any evidence submitted by the applicant regarding his or her criminal history.[49] As such, DHS would also use the (c)(18) applicant's biometrics to screen against government databases (for example, FBI databases) to determine if he or she matched any criminal activity on file. USCIS will continue to notify applicants of the proper date, time, and location to submit their biometrics after the application for employment authorization has been filed.

Furthermore, DHS proposes to require a biometric services fee of $30 for (c)(18) Start Printed Page 74215 EAD applicants. See proposed 8 CFR 106.2(a)(32(i)(C). DHS requires a biometric services fee of $30 to be collected where the underlying immigration benefit fee does not capture or incorporate biometric service costs.[50] See 8 CFR 103.17 & 106.2(a)(32)(i)(A), (B). DHS did not require a biometric services fee for (c)(18) EAD applicants in the 2020 USCIS fee rule because this proposed rule and the USCIS fee rule were under development simultaneously, yet independently of one another. See 84 FR 62280-62371 (Nov. 14, 2019). Additionally, (c)(18) EAD applicants do not have an underlying immigration benefit application or petition that they must file into which associated biometric submission and processing costs can be incorporated. Therefore, to recover the cost of biometrics services for (c)(18) EAD applications, DHS must require a biometrics fee for a (c)(18) EAD applicant. Thus, DHS proposes to require a $30 biometric services fee with the Form I-765 for (c)(18) EAD applicants. See proposed 8 CFR 106.2(a)(32)(i)(C).

D. Aliens Granted Deferral of Removal Under the Regulations Implementing CAT

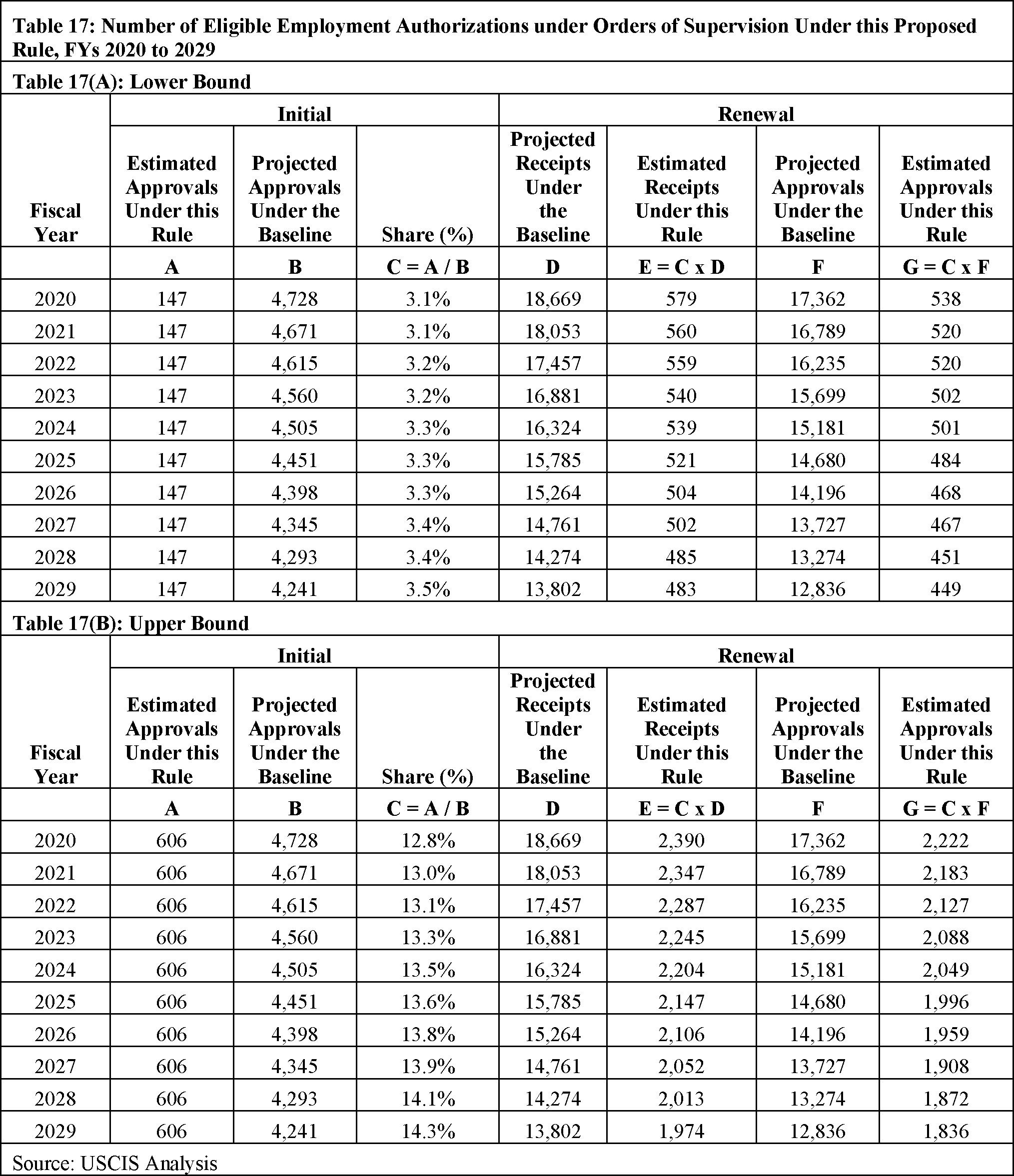

Once an alien has been granted withholding or deferral of removal, DHS cannot remove the alien to the country from which removal has been withheld or deferred unless withholding or deferral are terminated under applicable regulatory procedures set out in 8 CFR 208.24, 1208.24, 208.17, 1208.17, or 1208.18(c). The average number of aliens granted CAT deferral of removal over a 5-fiscal-year period was 147, and these numbers have not changed significantly over the last decade.[51] As reflected in Table 8 below, the number of aliens granted CAT deferral from FY 2014 through FY 2018, remains low.

| Fiscal year | CAT deferral of removal |

|---|---|

| 2014 | 121 |

| 2015 | 121 |

| 2016 | 140 |

| 2017 | 175 |

| 2018 | 177 |

| 5-Year Average | 147 |

| * U.S. Department of Justice, Executive Office for Immigration Review, Statistical Yearbooks for FY 2014-FY 2018. | |

Currently, aliens who are not going to be removed because they are granted withholding of removal based on section 241(b)(3) of the INA, 8 U.S.C. 1231(b)(3), or the regulations implementing CAT are employment authorized based on the grant of withholding. See 8 CFR 274a.12(a)(10). However, DHS's regulations do not clearly indicate the basis for withholding of removal (INA section 241(b)(3) or CAT). DHS has determined that aliens who receive CAT deferral of removal should also be included in the regulatory category governing employment authorization for aliens granted withholding of removal. Aliens granted deferral of removal will be employment authorized based on the grant of deferral, until deferral is terminated under applicable regulations. DHS proposes to amend the regulations to make these clarifications.

E. Effective Date of the Final Rule

With the exception of aliens whose removal DHS has determined is impracticable because all countries from whom DHS has requested travel documents have affirmatively declined to issue such documents, DHS proposes to apply changes made by this rule only to initial and renewal applications under 8 CFR 274a.12(c)(18) filed on or after the effective date of the final rule. DHS proposes to allow aliens temporarily released on orders of supervision who are already employment authorized prior to the final rule's effective date to remain employment authorized until the expiration date on their EAD, unless the card is revoked under 8 CFR 274a.14. USCIS would continue processing any pending application for a replacement EAD received before the effective date and receiving new applications for replacement EADs because those adjudications are not considered a new grant of employment authorization but a replacement of an EAD based on a previously authorized period.

DHS further proposes to allow aliens temporarily released on orders of supervision who are granted discretionary employment authorization after the effective date of the final rule to have their employment authorization renewed only if: (1) DHS determines the alien's removal is impracticable because all countries from whom DHS has requested travel documents have affirmatively declined to issue such documents, (2) the alien shows economic necessity for employment, (3) the alien is employed by a U.S. employer who is a participant in good standing in E-Verify (renewals only), and (4) the alien establishes that he or she warrants a favorable exercise of discretion to obtain employment authorization. DHS is proposing in this rule that it will consider an E-Verify employer to be a participant in good standing if the employer: (1) Has enrolled in E-Verify with respect to all hiring sites in the United States that employ an alien temporarily released on an order of supervision who has received employment authorization under this rule as of the time of filing of the alien's application for employment authorization, (2) is in compliance with all requirements of the E-Verify program, including but not limited to verifying the employment eligibility of newly hired employees at those hiring sites, and (3) continues to be a participant in good standing in E-Verify at any time during which the employer employs an alien temporarily released on an order of supervision who has received employment authorization under this rule.

F. Additional Amendments